Gold prices hit their highest level of the year on Thursday, driven by bets that inflation will remain sticky despite recent declines.

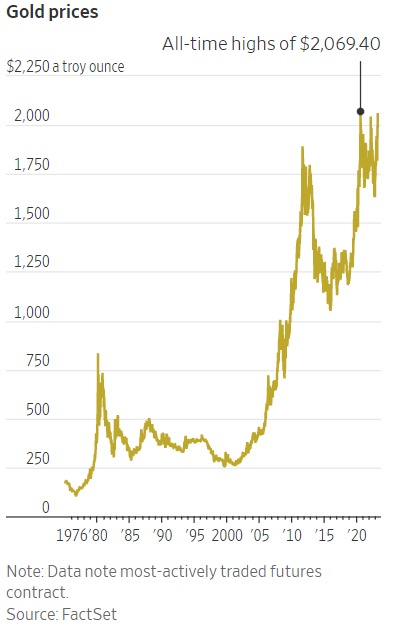

The most actively traded gold-futures contract rose to $2,055.30 a troy ounce, up 13% year to date. That also put it within striking distance of its record high, reached in the summer of 2020.

Some investors value gold as a hedge against inflation, expecting the precious metal to hold up in value if other assets fall. Its rally this week, however, comes after two closely watched data prints showed that inflation is slowing.

The rising gold price shows investors are wagering that the Federal Reserve will pull back from its rate-hiking campaign even with inflation readings well above the central bank’s 2% target. That in turn is born from concerns that the economy might be weaker than it seems. Though the labor market remains strong, last month’s banking crisis jolted worries that the economy remains vulnerable to even short-term headwinds.

A reversal by the Fed could result in higher inflation becoming embedded in the economy in coming years, analysts say, creating an environment that favors higher gold prices.

Brian Jacobsen, senior investment strategist at Allspring Global Investments, said gold prices have been lifted by an unusual combination of expectations on falling economic growth and rising inflation.

“The cold hand of reality slapped a lot of people in the face that we’re not going to get to target inflation this year or next,” Mr. Jacobsen said. “And it is unfortunate that it’s at the same time that growth expectations are also falling.”

Data on Thursday showed that the producer-price index, which generally reflects supply conditions across the economy, rose 2.7% in March from a year earlier, down from the highs of 2022 but above prepandemic levels. Data released Wednesday told a similar story about consumer inflation. It rose 5% in March from the previous year, down from a multidecade high reached last June but still far above normal.

Federal Reserve minutes released this week show that officials expect to continue raising short-term interest rates from their recent target of 4.75% to 5%—a statement of intention that bond markets have long questioned.

“There’s expectations that the Fed will probably not deliver on the hawkish rhetoric that they’ve been talking about,” said Bart Melek, head of commodity strategy at TD Securities. “The market’s kind of going, ‘Well, that’s great, but we think you’re going to capitulate quicker.’ ”

Last month’s banking turmoil could also influence the Fed’s rate path. Many analysts say banks could pull back on lending, creating tighter economic conditions. That in turn could propel the Fed to pare back from its rate raising.

Even the idea that the Fed could stop raising rates soon “has been enough to get things going,” said Peter Boockvar, chief investment officer at the Bleakley Financial Group. The firm owns physical gold and silver exchange-traded funds, along with shares of mining companies.

Mr. Boockvar expects the Fed to cut rates once or twice in the back half of the year, and he expects inflation to hover at roughly 3% to 4% in 2024.

Gold has also been boosted by a recent drop in Treasury yields. Nervous investors have scooped up Treasurys recently as they try to parse conflicting signals about the health of the U.S. economy. That has dragged down Treasury yields and thus increased the appeal of holding gold, even though it doesn’t offer regular income like bonds.

Lower yields have also weakened the dollar. That has made it cheaper for foreign investors to buy gold, which is priced in dollars.

The front-month gold futures contract has climbed about 12% this year, whereas the benchmark S&P 500 index has gained 8%.

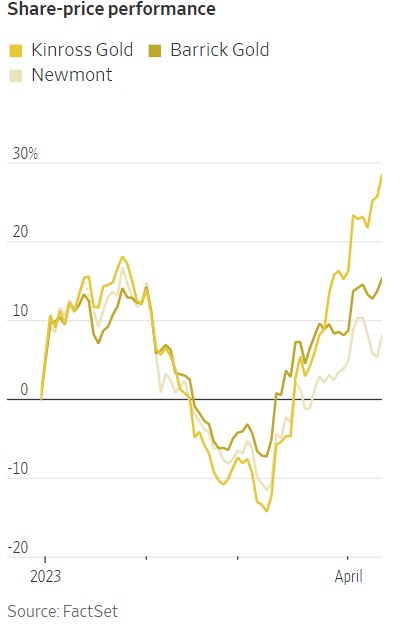

Shares of precious-metals miners have benefited from gold’s advance this year. Newmont Corp. has gained 8.1%, Canadian-listed shares of Barrick Gold Corp. have rallied 15% and Kinross Gold Corp. has added 28%.

Investors prize gold in times of turmoil because it has held value for thousands of years. In 1971, President Richard Nixon ended a fixed gold-dollar conversion price, allowing the dollar to float freely against other currencies.

This year’s advance for the metal, used in everyday items from jewelry to electronics, comes after it ended 2022 flat. Gold avoided the steeper losses posted by stocks and bonds but still disappointed those who had expected it to thrive during an era of persistent inflation.

Prices have been powered this year first by wagers that slowing growth and cooling inflation would force the Fed to pivot from its aggressive monetary policy, and then by fears that banking troubles would kick off an economic slowdown.

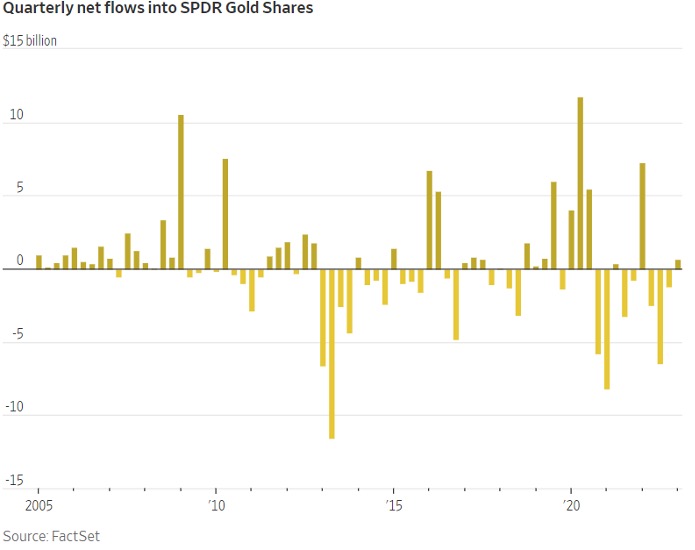

Investors poured a net $653 million in the first quarter into SPDR Gold Shares, the world’s largest physically backed gold ETF. That marks the largest quarterly inflow since the $7.29 billion received during the first quarter of 2022, according to Dow Jones Market Data. The fund gained 8% over the same period, its largest percentage gain since the three-month period ending December 2022.

“It’s had a very strong run of late,” said Matt Dmytryszyn, chief investment officer at Telemus, who expects prices to trade between $1,900 to $2,100 over the next six to 12 months. He is planning to take advantage of the higher prices and sell some of his gold ETF’s holdings.

To be sure, no new bank failures have been announced in recent weeks, and the economy by many measures continues to be strong.

Recent projections show Fed officials expect the federal-funds rate to rise to at least 5.1%.

Wall Street finds that hard to believe. Derivatives markets show traders expect the federal-funds rate to peak at roughly 4.99% in May, then fall to about 4.375% by the end of the year, according to FactSet.

For now, Mr. Boockvar is sticking with his gold holdings.

“Being a gold bull has taken a lot of patience, an extraordinary amount of patience. I believe that patience is about to be rewarded,” Mr. Boockvar said.

Reference:

Hardika Singh. (April 13, 2023). Gold Prices Near Record as Investors Bet Inflation Is Here to Stay. The Wall Street.

The Article is Reference from:

https://www.wsj.com/articles/gold-prices-near-record-as-investors-bet-high-inflation-is-here-to-stay-66a8956?page=1

Swipe left and right to see everything