Venture-capital-fund performance is languishing amid the broader downturn for tech startups, denting returns for university endowments, pensions and other investors that increased their exposure to the sector during the bull market.

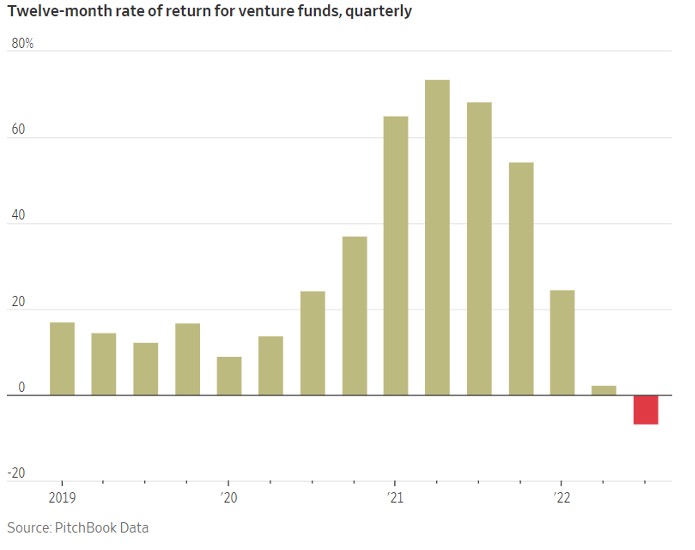

For the first time in more than a decade, returns for venture funds were negative for three consecutive quarters last year, according to research firm PitchBook Data, as investors finally began to mark down startups that had ballooned in value. Initial data for the fourth quarter also show a negative quarterly return.

The data also show that the yearly internal rate of return hit minus 7% in the third quarter—the latest data available for that measure—the lowest value for those three months since 2009. The internal rate of return is used to measure the profitability of venture funds on an annual basis and is a key performance metric used by the industry.

The decline marked the fifth consecutive quarter of deteriorating yearly rates of return—the first time this has happened in a decade—and was also the only negative rate of return among seven investment categories tracked by PitchBook, including private equity and real estate.

Fund investors say they remain optimistic about the long-term potential of the venture industry, citing new areas of technological growth like artificial intelligence. Even with last year’s decline, venture-capital funds outperformed other private investment strategies when measured over periods of three years or longer, the data show.

But the severity of the recent declines is already pushing some investors to re-evaluate their exposure to the sector.

These fund investors, known as limited partners, are bracing for further markdowns and say that the funds that invested the bulk of their cash during the peak of the bull market will likely post subpar returns.

“There is a segment of the venture market that has little traction and no real prospects for raising additional capital,” said Jay Ripley, the head of investments at Global Endowment Management, about some of the startups that venture funds backed a few years ago. “Those are presumably going to be written down to zero, or near zero.”

Mr. Ripley, whose firm invests in venture funds on behalf of nonprofit foundations and other institutions, said that the cooled market is pushing large investors to cut their commitments to certain venture firms and be more selective about the new funds they back. Fundraising for new venture funds hit a nine-year-low earlier this year, The Wall Street Journal reported.

Many large investors started backing startups through venture funds as interest rates stuck near zero, looking for better returns from tech companies that were staying private longer. Startups are a riskier asset that also offered the prospect of a bigger profit—and venture returns outpaced those of other investments for years.

The resulting flood of cheap capital boosted the paper valuations of startups to levels that far surpassed their maturity as businesses. In the second quarter of 2021, the yearly internal rate of return for venture funds was 74%, a record, the PitchBook data show.

As the selloff in technology stocks deepened last year, new funding for startups slowed and venture firms began to lower the internal value they assigned to their startup investments, affecting fund performance. Many of these firms had invested the bulk of their cash when private valuations hit record highs two years ago, contributing to the severity of the markdowns.

In 2022, Tiger Global marked down the value of its startup investments by about 33% across its venture-capital funds, the Journal reported, erasing $23 billion in value. The firm was the most active U.S. startup investor in 2021 and developed a reputation for paying high prices to win competitive deals.

The tech-heavy Nasdaq has risen around 20% since the beginning of the year, raising the prospects of a broader recovery in technology valuations. But venture investors say that the bulk of startup write-downs have yet to occur, given that the market is still far below its 2021 peak, and that they expect more companies to raise cash at lowered valuations in the coming months.

Japanese technology investor SoftBank Group 9984 0.99%increase; green up pointing triangle reported a $3.9 billion loss in the private holdings of its Vision Fund for the first quarter, citing the markdowns of weaker-performing startups and the share-price declines among similar public businesses. The fund, launched in 2017, has backed hundreds of privately held startups and is the largest venture fund raised to date.

The third-quarter yearly return rate of minus 7% was driven by the poor performance of larger funds—over $250 million—that invested more heavily in mature companies as opposed to startups just getting off the ground, according to PitchBook.

These companies have suffered the most severe markdowns of late, investors said, and may now have to spend years growing their businesses before they can raise cash at higher valuations than their latest fundraisings.

In March, payments giant Stripe raised new funding at a $50 billion valuation, down from $95 billion in March 2021. Such “down rounds,” where startups raise cash at lower prices, have become more common in recent months, investors say.

“Too much capital flooded into the ecosystem in venture capital, in particular in the time period between 2015 and 2021,” said Max Gazor, a general partner at VC firm CRV. That environment caused venture firms to “bid excessively high prices” to win competitive deals that may now look overvalued, he said.

Venture firms have varying methodologies for assessing the value of their portfolios and were largely slow to mark down startup values when the technology market first plunged over a year ago, according to investors and industry analysts. Some held out on marking down their startups in the hopes that the public market would soon rebound, they said.

Now, they are finally beginning to feel the sting.

“Some of these recent vintage years won’t look great,” Mr. Ripley of Global Endowment Management said. “If you deployed a lot of money in 2021 at 2021 prices, that’s not going to feel good.”

Reference:

Barber Jin. (May 16,2023). Venture-Fund Returns Show Worst Slump in More Than a Decade. The Wall Street Journal.

https://www.wsj.com/articles/venture-fund-returns-suffer-amid-lower-startup-values-15dc0130?mod=markets_lead_pos2

Swipe left and right to see everything